Investing in the stock market might sound intimidating and complicated for beginners. However, with the right investment app, you can start your investment journey with just a tap on your smartphone. This article will guide you through the top investment apps to get your financial journey started.

Understanding Investment Apps

Investment apps are digital platforms that allow individuals to invest in various financial securities right from their mobile devices. They offer a range of services, from buying and selling stocks, ETFs, and bonds to portfolio management and financial planning.

Note: Investing involves risks, including the potential loss of the principal amount invested. Therefore, it’s crucial to invest wisely and seek professional advice if needed.

How do Investment Apps Work?

Investment apps are straightforward to use even for beginners. Users need to download the app, create an account, link their bank account, and start investing. These apps typically offer different investment vehicles, including taxable brokerage accounts, robo-advisors, Individual Retirement Accounts (IRAs), or even 529 college savings accounts.

Key Features of Investment Apps

When selecting an investment app, look for the following features:

1. Low Fees: The best investment apps offer low fees or zero-commission trades.

2. Variety of Investment Options: Look for apps offering a wide range of investment options, including stocks, ETFs, bonds, and mutual funds.

3. Account Flexibility: The app should provide various account types, such as individual, joint, retirement, and custodial accounts.

4. Educational Resources: For newbie investors, educational resources like guides, videos, or webinars can be helpful.

5. Strong Customer Support: Reliable customer support can assist you with troubleshooting and investment-related queries.

With these features in mind, let’s dive into the top investment apps for beginners.

Top Investment Apps for Beginners

1. Robinhood for Active Trading

Robinhood is an app that pioneered the concept of commission-free trading. It offers a user-friendly platform for beginners and active traders to trade stocks, ETFs, options, and even cryptocurrencies.

Pros of Robinhood:

- No commission on trades

- Allows fractional shares trading

- Offers a premium service, Robinhood Gold, for access to professional research and extended trading hours

Cons of Robinhood:

- Lack of mutual funds and bonds

- No tax-advantaged retirement accounts

2. Acorns for Micro-Investing

Acorns is an app designed for novice investors looking to start small. It allows users to invest their spare change in diversified ETFs.

Pros of Acorns:

- Automatic investing with round-ups

- Customizable portfolios

- Offers sustainable portfolios for ESG investing

Cons of Acorns:

- Monthly fee can be high if investing small amounts

- Limited investment options

3. Betterment for Automated Investing

Betterment is a robo-advisor app that uses algorithms to manage your investment portfolio.

Pros of Betterment:

- Personalized investment strategies

- Automatic rebalancing and tax-saving strategies

- Access to financial advisors for premium users

Cons of Betterment:

- Annual account fee

- Premium plan requires a high minimum balance

4. Public.com for Social Features

Public.com is an app that combines investing with a social media-like experience. Users can share their thoughts on different investments and learn from others.

Pros of Public.com:

- Commission-free trades

- Allows fractional shares trading

- Social networking features

Cons of Public.com:

- Limited selection of securities

- No mutual funds, bonds, or options trading

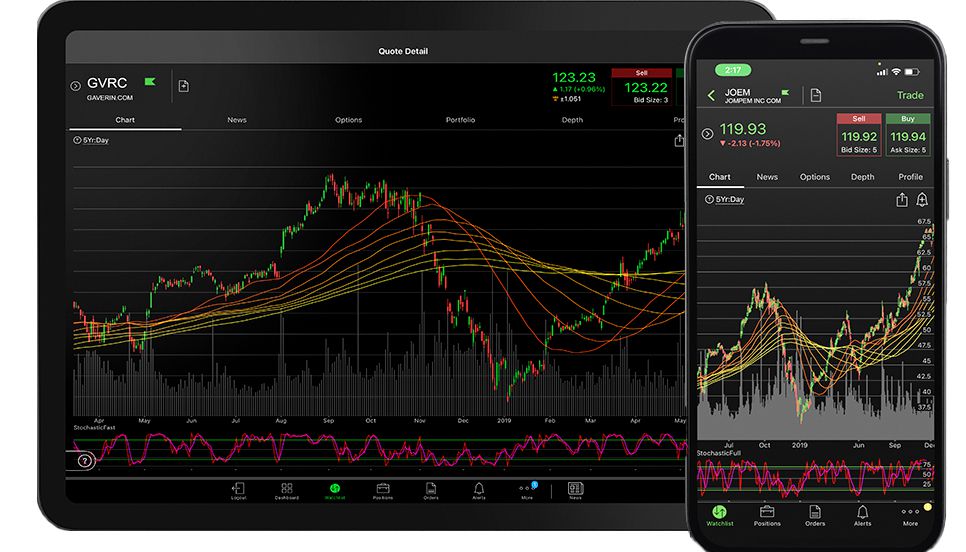

5. TD Ameritrade for Educational Tools

TD Ameritrade is an app offering a comprehensive selection of investments along with strong customer service and educational resources.

Pros of TD Ameritrade:

- Wide range of investment options

- Excellent research and educational resources

- No account minimums or trade commissions

Cons of TD Ameritrade:

- High fees for broker-assisted trades

- No forex trading

6. SoFi for All-in-One Financial Services

SoFi is an app offering a wide range of financial services, from investing and banking to lending and financial planning.

Pros of SoFi:

- Allows fractional shares trading

- Offers robo-advisory and self-directed trading

- Access to certified financial planners

Cons of SoFi:

- Limited selection of securities

- No mutual funds

7. Charles Schwab for Experienced Traders

Charles Schwab is a comprehensive investment app offering a wide range of services for all levels of investors, especially experienced ones.

Pros of Charles Schwab:

- Wide range of investment options

- Excellent research and educational resources

- No account minimums or trade commissions

Cons of Charles Schwab:

- High fees for mutual funds outside of its no-transaction-fee program

- Account minimum for robo-advisory service

Wrapping Up

Investment apps have made investing more accessible and convenient, especially for beginners. It’s critical to choose an app that aligns with your investment goals, risk tolerance, and financial situation. Always remember, while investing can generate returns, it also comes with risks. Therefore, educate yourself, start small, and gradually build your investment portfolio.